Seems these days I’m only ever writing an annual update blog post. A lot has happened since this time last year!

First of all, in June 2021, I married my most amazing Kate in the beautiful surrounds of Numinbah Valley. We managed to have the wedding in the small window of time when my dad and step-mum could make it across from New Zealand (though we lost a few friends to a Melbourne lockdown).

Following the wedding, we zipped off to Tasmania for a fabulous couple of weeks, including the most picturesque day that I think Cradle Mountain has ever experienced (pictured - yes, that’s my photo, not a stock photo).

In late 2021, I applied for and was granted both CPA membership personally, and a Public Practice Certificate for Blue Ribbon Accounting. These additional memberships and registrations give you assurance that we are operating under stringent quality standards, and also that I am continually working to maintain and improve my accounting knowledge to better serve my clients.

If that wasn’t enough, in the first two months of 2022, Kate completed a full round of IVF, and we bought a townhouse in Camp Hill (local to the office!). It turns out Kate is an over-achiever in every aspect of life, and we ended up with NINE embryos in the freezer at the end of the IVF round.

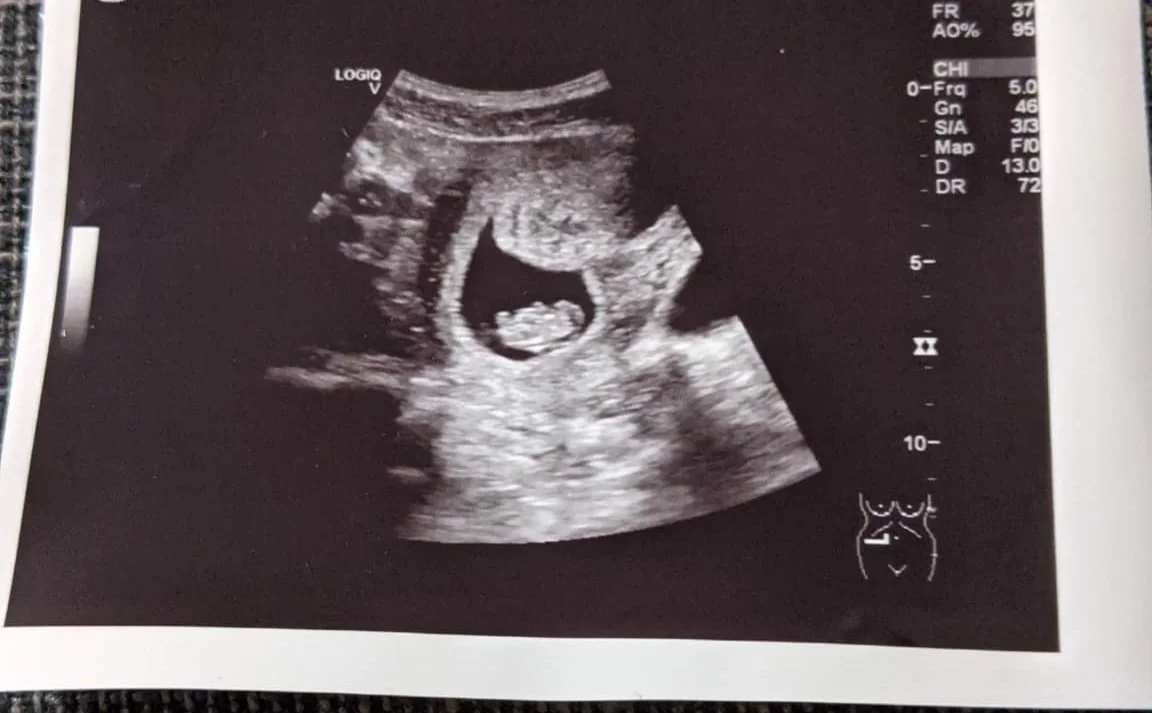

While our first implant didn’t take, the second one stuck, and WE ARE EXPECTING!

Eggnatius Heath-Creevey (Eggy for short - gotta have a foetus name) is due on 28 December 2022, but might arrive a little bit earlier.

With all of these changes occurring, I’ve taken the time to assess my business practices and ensure that I’m maximising my effective time and my service offering. I will be steering away from ‘in home’ appointments and appointments that require travel away from my office, so that I can ensure that I serve as many clients as possible before Eggy’s arrival, and continue to work efficiently after Eggy’s arrival.

I appreciate your efforts in working with my team to ensure that I can establish an excellent work and family balance from the very beginning.

PRICING UPDATE

I have endeavoured with this update to balance continuing to provide well priced services with the ongoing increases in the cost of living, and with the steps Blue Ribbon Accounting have taken in the past 12 months to improve their service offering quality through professional memberships.

Items on the pricing page now reflect new pricing which will apply from 1 July 2022.

Broadly, prices have increased by approximately 8%, with a basic summary of increases below:

Individual Tax Returns - $143 each

Tax Return add-ons - $71.50 each

Separated pricing for small business tax returns vs preparation of financial reports (now each at $214.50)

General hourly rate $143 for large jobs and advisory work

BAS lodgement minimum charge $82.50 (bookkeeping rate remains at $77)